Faria Lima Plaza

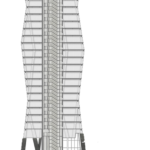

O Faria Lima Plaza (FLP) é uma torre comercial AAA (Triple A) localizada na Avenida Faria Lima. O edifício conta com 40.937 m2 (440.643 pés quadrados) de área BOMA, dispondo de mais de 20 andares e 6 pisos de estacionamento subterrâneo com mais de 1.200 vagas.

Projeto

O Faria Lima Plaza está em uma localização privilegiada, situando-se ao lado do Largo da Batata com a Av. Faria Lima, que dá acesso ao principal centro financeiro de São Paulo.

O conceito do projeto é o de um abraço entre duas formas que se entrelaçam elegantemente e dinamicamente como em uma dança.

As placas do piso da torre variam levemente em tamanho, proporcionando uma variedade de opções para o locatário.

Os materiais em bronze e vidro dão uma aparência única, exibindo uma essência escura e dramática. O conjunto fica sobre uma plataforma contrastante de granito branco com degraus em meio a uma praça paisagística repleta de água e bancos sob uma torre elevada.

galeria

ARREDORES

Shoppings

• Shopping Iguatemi

• Shopping Eldorado

Clubes / Arte e Cultura

• Esporte Clube Pinheiros

• Clube Hebraica

• SESC Pinheiros

• Instituto Tomie Ohtake

Hotéis

• George V

• Ibis Styles Faria Lima

• Quality Inn

Ruas Gastronômicas

• Rua dos Pinheiros

• Rua Ferreira de Araújo

• Rua Sampaio Vidal

• Vila Madalena

• Rua Vupubassu

Restaurantes

• NB Steak

• Barakah Cozinha Árabe

• Mare Monti

• Cervejaria Nacional

• Churrascada do Mar

• Schnaps Haus Comida Alemã

• San Fran

• Nou Restaurante

• La Nonna de Lucca

• Adega Santiago

• Aoyama

• Goose Island Brewhouse

• Cabana

• Lanchonete da Cidade

• Botanikafe

• Ofner

• Bacio Di Latte

• Dama Confeitaria

mobilidade

O FLP oferece a melhor acessibilidade à rede de transportes públicos – comparado com qualquer torre comercial na Avenida Faria Lima – além de proporcionar acesso direto à rede municipal de ciclovias.

Estação Faria Lima

(Linha 4 - Amarela do Metrô)

Terminal Intermodal Pinheiros

Ciclovia

Trem Metropolitano

(Linha 9 - Esmeralda da CPTM)

LOCALIZAÇÃO

O FLP encontra-se na Av. Faria Lima, um dos maiores centros financeiros de São Paulo, entre os bairros dos Jardins e dos Pinheiros. A região recebeu inúmeras melhorias municipais na última década para se tornar uma referência em mobilidade urbana, acessibilidade e qualidade de vida.

A redondeza conta com um centro gastronômico na Rua dos Pinheiros, arte e cultura no Instituto Tomie Ohtake além do bairro boêmio da Vila Madalena, sendo uma das áreas mais cobiçadas de São Paulo.

ARQUITETURA

A Kohn Pedersen Fox Associates (KPF) é uma prática arquitetônica global voltada aos clientes que representam alguns dos desenvolvedores, empresas e instituições mais inovadoras do mundo. O portfólio da empresa engloba mais de 40 países e inclui uma ampla variedade de projetos, desde escritórios e complexos residenciais a prédios cívicos e culturais e instalações de pesquisa e educação. Focando em soluções individuais de design, a missão da KPF é criar edifícios e espaços da mais alta qualidade e sensibilidade contextual, provocando um impacto relevante em suas respectivas cidades. Conquistando o devido reconhecimento como uma das práticas de design arquitetônico mais respeitadas do mundo, os trabalhos da KPF foram amplamente exibidos, sendo o assunto de 13 monografias e conquistando mais de 400 prêmios.kpf.com

A KOM é uma empresa de arquitetura focada no design de projetos inovadores, incluindo torres corporativas, shopping centers, hotéis e projetos de uso misto. A empresa iniciou suas atividades em 1991 e está sediada em São Paulo. Alguns dos projetos mais importantes conduzidos pela KOM incluem: o Faria Lima 3500, uma das sedes do Banco Itaú em São Paulo; o Castelo Branco Office Park em Barueri; e o Edifício Roberto Marinho, sede da Rede Globo em São Paulo.komarquitetura.com.br

CORTE

DE

FACHADA

6 subsolos

• Média de 45 vagas por andar

• Estacionamento rotativo no local

sustentabilidade

O Faria Lima Plaza obteve a certificação LEED Gold concedida pelo US Green Building Council que fomenta a criação de edifícios sustentáveis, eficientes e econômicos, incorporando princípios de crescimento inteligente, urbanização e construção verde.

- Certificação LEED Gold For Core & Shell

- Selo Procel PBE Edifica

- Reuso de Águas Pluviais

- Central de Triagem de Resíduos

- Iluminação 100% LED

- Estações de Carregamento de Veículos Elétricos

- Sistema de Ar-Condicionado VRF (melhor eficiência energética)

- Mercado Livre de Energia

- Bicicletário com amplos vestiários

Prêmios Internacionais

Premiação:

Bernard Bühler Award | KPF

3º lugar de 150 submissões mundiais

Excellence in Concrete Construction Awards

High-Rise Structures

2º lugar

Estruturas de arranha-céus

Faria Lima Plaza, São Paulo, SP, Brasil. O edifício Faria Lima Plaza representa um projeto moderno e inovador, se destacando principalmente por sua arquitetura diferenciada. Possui aproximadamente 110 m (360 pés) de altura e têm pilares inclinados que mudam de direção ao longo de seu comprimento. A concepção arquitetônica é baseada em duas formas que se entrelaçam de modo elegante e dinâmico, como em uma dança. Essa arquitetura arrojada exigiu uma engenharia de alto nível para que o projeto fosse realizado com sucesso, considerando não apenas os desafios técnicos, mas também as dificuldades logísticas para a construção de um edifício desse porte em uma região de muito movimento da cidade de São Paulo.

O empreendimento também obteve a pré-certificação LEED Gold, confirmando sua estrutura sustentável, eficiente e econômica, baseada nos princípios de crescimento inteligente e construção verde. O estudo do concreto focou na obtenção de concepções de mistura otimizadas com redução do teor de cimento e das emissões de CO₂ na atmosfera, contribuindo dessa forma para a sustentabilidade do projeto. A solução estrutural para a fundação previa a construção de uma sapata combinada com um volume de 1400 m³ (1830 yd³) de concreto e 3 m (10 ft) de altura, e requeria estudos térmicos detalhados para definir tanto o plano de concretagem como os níveis de pré-resfriamento do concreto fresco. Os pilares inclinados exigiram a realização de diversos ensaios químicos, inclusive testagem de fluência para diferentes composições de concreto. Não há registro de outra obra no Brasil para a qual este teste tenha sido feito. O Faria Lima Plaza já se tornou um símbolo entre os muitos arranha-céus de São Paulo e tem um enorme potencial para se tornar uma referência arquitetônica e de engenharia de alto nível na maior cidade da América do Sul.

Equipe do Projeto Membros: Desenvolvedor: VR Investimentos; Escritório de Arquitetura: Kohn Pedersen Fox Associates; Empresa de Engenharia: Construtora Fonseca & Mercadante; Empreiteiro Geral: VR Investimentos; Empreiteira de Concreto: Construtora Fonseca & Mercadante; Fornecedor de Concreto: Votorantim Cimentos S/A ‐ Engemix; Empresa de Projeto Estrutural: Pasqua & Graziano Associados; Empresa de consultoria em concreto: DESEK.

Proponente: Instituto Brasileiro Do Concreto (IBRACON)

Fonte:

https://www.concrete.org/…

PROPRIETÁRIOS

VR Investimentos é uma empresa familiar brasileira que investe de forma temática em todas as classes de ativos, com foco principal em ações privadas e públicas, em uma variedade de setores e regiões. Seu foco é desenvolver parcerias duradouras e investir por meio de um horizonte de investimento de longo prazo. Com sede em Nova York, a VR Investimentos alavanca sua profundidade de recursos como um parceiro estratégico com experiência na aplicação de inovação tecnológica e sucesso em condições financeiras voláteis. Seus resultados são alavancados através de sua vasta experiência em inovação tecnológica, de sua antecipação a mudanças econômicas e sociais e de sua capacidade de operação em ambientes desafiadores, em constante evolução.

VR Investimentos é uma empresa familiar brasileira que investe de forma temática em todas as classes de ativos, com foco principal em ações privadas e públicas, em uma variedade de setores e regiões. Seu foco é desenvolver parcerias duradouras e investir por meio de um horizonte de investimento de longo prazo. Com sede em Nova York, a VR Investimentos alavanca sua profundidade de recursos como um parceiro estratégico com experiência na aplicação de inovação tecnológica e sucesso em condições financeiras voláteis. Seus resultados são alavancados através de sua vasta experiência em inovação tecnológica, de sua antecipação a mudanças econômicas e sociais e de sua capacidade de operação em ambientes desafiadores, em constante evolução. Fundada em 2003, a Capitania Investimentos é uma gestora independente e especialista em crédito privado, infraestrutura, agro e imobiliário. Com mais de 20 anos de história, possui atualmente cerca de R$ 25 bilhões sob gestão e conta com mais de 350,000 investidores. No segmento imobiliário já desembolsou mais de R$ 12 bilhões em operações de crédito e possui cerca de R$ 4 bilhões investidos em cotas de Fundos Imobiliários. A Capitania conta com uma equipe altamente qualificada, composta por 31 profissionais envolvidos na gestão dos fundos.

Fundada em 2003, a Capitania Investimentos é uma gestora independente e especialista em crédito privado, infraestrutura, agro e imobiliário. Com mais de 20 anos de história, possui atualmente cerca de R$ 25 bilhões sob gestão e conta com mais de 350,000 investidores. No segmento imobiliário já desembolsou mais de R$ 12 bilhões em operações de crédito e possui cerca de R$ 4 bilhões investidos em cotas de Fundos Imobiliários. A Capitania conta com uma equipe altamente qualificada, composta por 31 profissionais envolvidos na gestão dos fundos.

Contato

+55 11 5185.4688

+55 11 2110.9000